What IS A E- INVOICE ?

Wondering what an e-invoice is and if you require the service? Let us guide you to the light.

The concept of E-invoicing for India is a big move due to the volume of business transactions are undertaken every day, and the overabundance of different, non-standard, zed formats used in invoice generation. The concept of e-invoicing maybe new to Indian tax payers but about 70 countries have already adopted it over the past few decades.

The 39th GST Council meeting has decided to implement the GST e-invoicing of bills under the GST scheme and applicability of QR codes to start from 1st October 2020 in the view of the ongoing pandemic.

The GST e-invoicing will provide multiple categories under which the taxpayer will fill the e-invoice as per the turnover and other criteria. The CBIC had notified vide Notification No. 61/2020 – Central Tax; e-invoicing for businesses with turnover above Rs 500 Crore, increasing the threshold for mandatory issuing of electronic invoices from the earlier limit of Rs. 100 Crore turnover providing relief to small scale companies. Once registered, the taxpayer must generate an e-invoice even if the turnover decreases by less than 500 Crores in the subsequent year.

To sum up, E-invoice is a standard mechanism or schema for data exchange between different manufacturers’ GST billing software.

How Will Electronic Invoicing Benefit The Businesses

Businesses will have the following benefits by using e-invoice initiated by GSTN: E-invoice resolves and plugs a significant gap in data reconciliation under GST to reduce mismatch errors E-invoices created on one software can be read by another, allowing interoperability and reducing data entry errors. Real-time tracking of invoices prepared by the supplier is enabled by e-invoice Backward integration and automation of the tax return filing process – the invoices’ relevant details would be auto-populated in the various returns, especially for generating the part-A of e-way bills. Faster availability of genuine input tax credit. The Lesser possibility of audits/surveys by the tax authorities since the information they require is available at a transaction level E-invoicing can be further used for creating e-way bills by providing only vehicle details. Invoices uploaded by suppliers for authentication will be automatically shared with buyers for reconciliation. The system will auto-match input credit liability with output tax. E-invoice can be created for Debit/Credit Notes, Invoices, and other eligible documents. So we are here to help you get your E-invoicing the most effortless way without any trouble with a few simple steps :

Step 1: Invoice Creation

The seller/supplier will create an invoice in the directed format (e-invoice schema) using his/her accounting or billing software. It must have the mandatory details.

The accounting software of the supplier will generate a JSON for each B2B invoice. The JSON will upload the file to the IRP.

Step 2: IRN Generation

The next step would be to generate an individual Invoice Reference Number (IRN) by the seller using a standard hash-generation algorithm.

Step 3: Invoice Uploading

The seller will upload JSON for each of the invoices, along with IRN, to the Invoice Registration Portal, either directly or through third-party software.

Step 4: Authentication and Signing

IRP will validate the hash/IRN attached with JSON or generate an IRN if not already uploaded by the supplier.

Then, it will authenticate the file against the central registry of GST.

Upon successful verification, it will add its signature on the invoice and a QR code to JSON.

Hash generated earlier will become the new IRN of the E-invoice. It will be the unique identity of that e-invoice for the entire financial year.

Step 5: Sharing of Data

The uploaded data will be shared with the E-way bill and GST system.

Step 6: E-invoice Downloading The portal will send the digitally-signed JSON along with IRN and QR code back to the seller. The invoice will also be sent to the buyer on their registered email id.

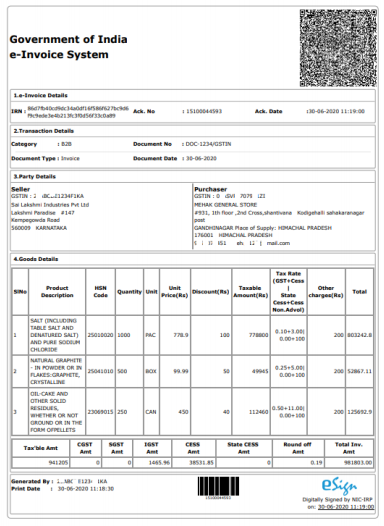

How does the e-invoice application look?

We hope this information was of much importance to you. For further queries on Tally ERP 9, contact us at amsantechnology.com